Getting into a car accident is stressful enough, but in Saudi Arabia, digital services have turned what used to be a long, paper heavy ordeal into a fast and simple process. Thanks to Najm, the insurance services platform, you can now report, document, and follow up your accident claims directly from your phone. Here’s a clear guide to managing every step, from the crash scene to the payout in your bank.

The first few minutes after an accident are critical for your safety and your insurance claim. Always check that everyone involved is safe. If anyone is injured, call the ambulance at 997 and the traffic police at 993 right away, since Najm does not handle cases with injuries. Take clear photos of the scene, showing both the vehicles’ plates and damage angles. If the cars are drivable, move them off the road to avoid blocking traffic or getting fined.

The fastest way to get help is to open the Najm app. It pinpoints your location using GPS, letting you file the accident report in just a few taps. No need to wait on the phone or for a traffic officer—everything starts from your smartphone.

Najm has made it easier than ever to handle minor accidents without even needing an investigator to show up. With the “Report, Snap, Move” service, drivers simply upload photos of the accident using the app. These are either analyzed instantly by the system or reviewed by a remote investigator, so you get your official accident report within minutes.

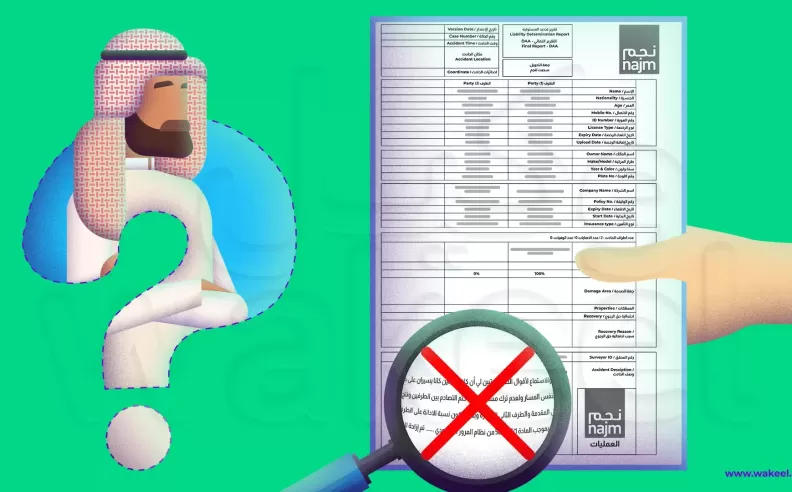

You can also use the app to track the status of your claim and see exactly when the investigator is on the way, if one is required. Once processed, you’ll receive a text message with a link to your digital report and accident number. This document is essential for the rest of the insurance process.

Once you have your Najm report, you need to book an appointment with the Taqdeer system to get your vehicle damage assessed. The damage report is sent directly to your insurance company—no need for in-person visits. Upload the accident number, evaluation report, and your IBAN bank details to your insurer’s website or app.

By law, insurance companies in Saudi Arabia are required to deposit your compensation within fifteen days of receiving all documents. Make sure your driver’s license and insurance policy are valid and up to date, as expired documents can delay or even block your payout. If the car is owned by a company or financed by a bank, ensure you have a valid electronic driving authorization before making any claims.

Started my career in Automotive Journalism in 2015. Even though I'm a pharmacist, hanging around cars all the time has created a passion for the automotive industry since day 1.